Prices for new homes in Bucharest increased by over 50% over 5 years, agency says

The average sale price for new homes in Bucharest has increased over the past 5 years by over 50%, from EUR 1,480 to EUR 2,273 per usable square meter. At the same time, the average rent rose by 45%, from EUR 8.6 to EUR 12.3 per usable square meter, according to a report from real estate agency iO Partners Romania.

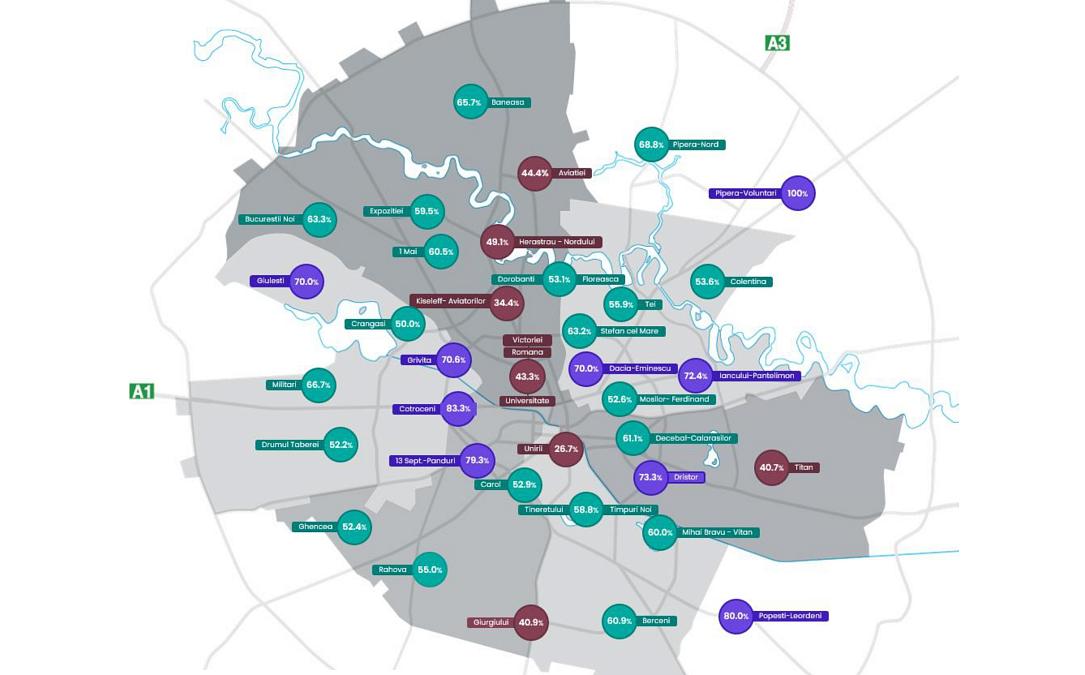

The increases are not equally distributed, and there are significant variations between neighborhoods. For example, in Pipera - Voluntari, prices doubled during the mentioned interval, while areas such as Cotroceni and Popesti-Leordeni increased by over 80%. At the opposite pole, neighborhoods such as Unirii or Romana saw limited growth of around 30%.

On the rental side, Dorobanti-Floreasca and Pipera Voluntari lead the ranking, with increases of nearly 90%, while Giurgiului and Crangasi experienced more modest increases, of approximately 20%.

With an average rental yield of 5.3%, Bucharest ranks in the upper area compared to other countries in the region (Warsaw 6.5%, Prague 3.5%, Budapest 5%, Vienna 3%).

“Even if the yields seem moderate at first glance, the local residential market still offers a safe and attractive environment for investors. The semi-central areas and the northern area remain benchmarks, with a constant appetite for quality homes and long-term tenants,” stated Andreea Hamza, head of Residential Advisory iO Partners Romania.

An overview of the residential market in 2025 highlights a visible transition from a wave of intense activity before the fiscal and legislative changes to a period of slowing demand. Residential demand had a predominantly downward evolution compared to the previous year, marked by volatility and a general feeling of caution among buyers, the same source said.

The only period of clearer growth last year was during the past summer months (July–August 2025), when the announcement of the increase of the reduced VAT rate from 5% to 21% led to a temporary acceleration of transactions during the grace period until the new measures came into force.

Nevertheless, prices continued to rise, even in the last quarter of the year. Overall, home prices increased in 2025 by 18% compared to the previous year. The volume of housing deliveries in Bucharest and Ilfov was below the level of the previous year and approximately 30% below initial estimates, a sign that some projects were postponed or resized.

For 2026, projects currently underway indicate a significant increase in volumes (a 48% increase in Bucharest and 84% in Ilfov). The materialization of these deliveries will depend directly on the evolution of demand and costs, with the risk that part of the deliveries may be pushed to 2027, according to iO Partners.

(Photo source: press release)