Bucharest metro area and two other counties accounted for most mortgage loans in 2025, study says

Bucharest and its surrounding metropolitan zone, which includes Ilfov county, along with the counties of Timis and Cluj, are the areas where the biggest numbers of mortgage loans were granted in Romania in 2025, according to a market analysis released by online broker Ipotecare.ro, based on official statistics.

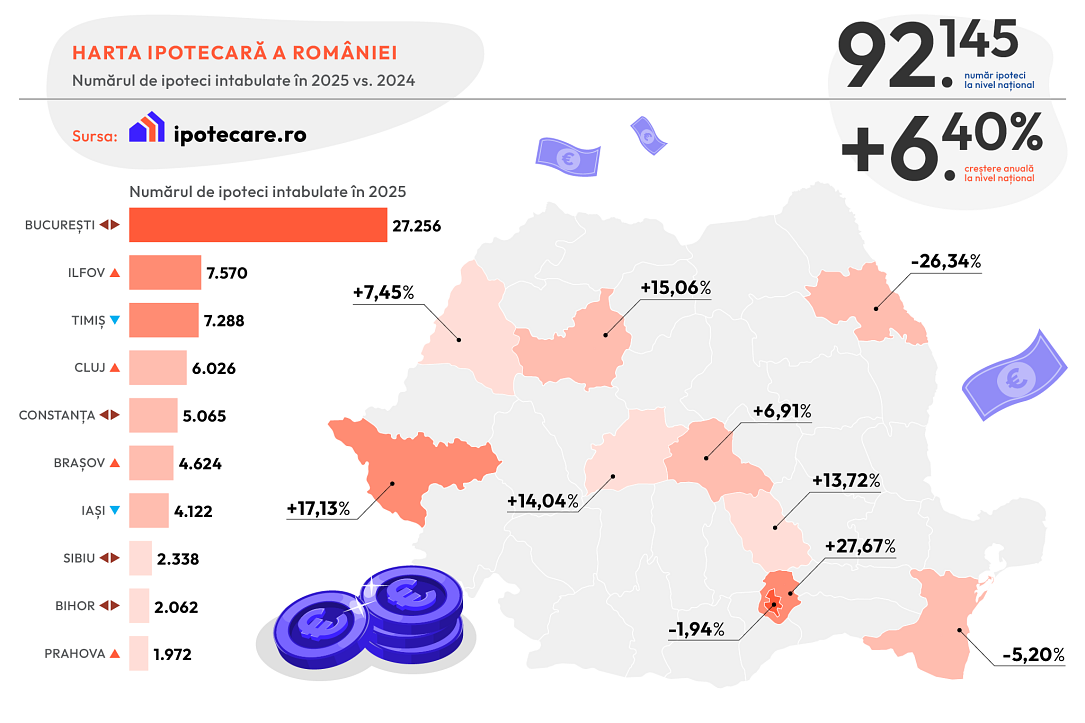

Over 92,100 mortgages were tabulated in Romania in 2025, up 6.4% compared to 2024. Over 27,000 were granted in Bucharest in 2025, almost 2% down compared to the previous year, while roughly 7,570 were given in Ilfov county.

Ilfov also registered the highest annual increase at a national level, of 27.6%, according to the data published by the National Agency for Cadastre and Land Registration. Together, Bucharest and Ilfov hold a share of almost 38% of the total number of mortgages tabulated in Romania in 2025.

The following positions in the ranking of the largest regional mortgage markets in the country are Timis, where almost 7,300 mortgages were tabulated, up 7.4% compared to 2024’s result, Cluj, where a little over 6,000 mortgages were tabulated, up 15% annually, and Constanta, with just over 5,000 mortgages tabulated, 5.2% lower compared to that of 2024.

Constanta is one of the only three regional markets where a decrease in the number of tabulated mortgages was recorded in 2025, along with Bucharest and Iasi, where 4,122 mortgages were tabulated, down 26.4% compared to 2024’s result.

The ranking of the largest regional mortgage markets in the country is completed by Brasov, Iasi, Sibiu, Bihor, and Prahova.

Overall, the top 10 mortgage markets in Romania account for over 74% of the number of mortgages tabulated last year at a national level.

”Romania’s mortgage market registered very good results in 2025: the share of residential transactions carried out through credit increased, the refinancing market also recorded a higher volume compared to 2024’s result, and cumulatively, we are heading towards a new record of mortgage loans granted. This growth is supported especially by first-time buyers, but also by customers who opted for a refinancing under more advantageous conditions,” said Catalin Marin, managing partner at SVN Romania | Credit & Financial Solutions, exclusive partner of Ipotecare.ro.

Continuing the trend, 2026 began with decreasing interest rates, with both IRCC and fixed rates being lower, and the demand for residential spaces with a higher level of comfort is equally high.

Compared to the total number of residential units sold last year in Romania, mortgages tabulated in 2025 hold a share of 57%, according to SVN’s calculations based on official statistics, up 51% from 2024. However, it should be noted that the total number of tabulated mortgages also includes refinancings, reconversions, and restructurings, as well as personal loans with mortgages.

According to the analysis, 2025 will close with a new record of mortgage loans granted in Romania. The most recent data published by the National Bank show that mortgage loans worth EUR 9.96 billion were granted in the first 11 months of 2025, up 22% compared to the first 11 months of 2024.

(Photo source: press release)