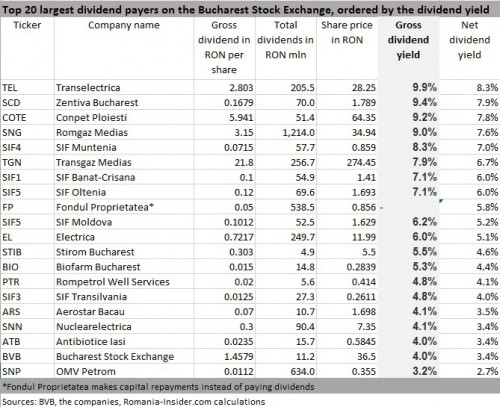

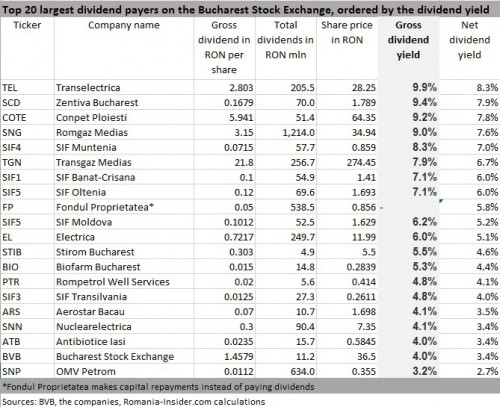

Which companies offer the biggest dividend yields on the Bucharest Stock Exchange?

Romania-Insider.com looks at the biggest dividend payers on the Bucharest Stock Exchange and at the shares which bring investors the biggest dividend yields.

The 20 largest dividend payers on the Bucharest Stock Exchange will distribute total dividends amounting to EUR 820 million in the following months from last year’s net profits. A calculation made by Romania-Insider.com shows that state-owned companies in the energy sector offer the highest dividend yields.

Transelectrica, which trades on the Bucharest Stock Exchange under the ticker TEL, is the star of this year’s dividend season. The company that operates Romania’s power grid offers the highest dividend yield. The dividend yield represents the ratio between the value of the dividend per share and the share price, or how much an investor gains for each euro invested in the company’s shares.

Transelectrica’s gross dividend yield is close to 10%, taking into account the closing share price on Wednesday, April 8, while the net dividend, after deducting the 16% tax rate on dividends, is 8.3%. For comparison, Spain’s electricity grid operator RED Electrica offered a gross dividend yield of 3.9% this year, according to Bloomberg data.

State-owned gas producer Romgaz Medias (BVB ticker: SNG) and gas transporter Transgaz Medias (TGN) are the other two big dividend payers this year. Romgaz, which posted record profit last year due to the gas price increase in Romania, has allotted the highest sum for dividends of all the listed companies, some EUR 275 million. The gross dividend yield for Romgaz is 9%.

Transgaz, which has been one of the steadiest dividend payers on the Bucharest Stock Exchange in the past five years, offers a gross dividend yield of 7.9% this year.

Newcomer Electrica (EL), which listed on the Bucharest Stock Exchange and the London Stock Exchange in July 2014, will also pay a substantial dividend yield of 6%.

But energy is not the only sector that compensates investors with attractive dividends. Pharmaceutical companies such as Zentiva Bucharest (SCD), Biofarm Bucharest (BIO) and Antibiotice Iasi (ATB) will also distribute some of their profits to shareholders. Zentiva pays the second highest dividend yield on the Bucharest Stock Exchange, of 9.4%.

Listed investment funds, such as SIF Muntenia (SIF4), SIF Banat-Crisana (SIF1), SIF Oltenia (SIF5) and SIF Moldova (SIF2) restarted dividend payments after they drew a lot of critics in the past years for trying to withhold dividends and keep the profits for investments. The four SIFs pay gross dividend yields between 6% and 8.3%.

Fondul Proprietatea (FP), Romania’s largest investment fund, will compensate its shareholders not with dividends but with capital returns, which are not taxable. The net yield of these returns is currently 5.8%.

The largest listed company on the Bucharest Stock Exchange, oil and gas producer OMV Petrom (SNP), is less generous this year. The company decided to cut its dividends to a third compared to last year, as its profit went down in 2014, on lower oil prices. This puts OMV Petrom on the last place among the 20 largest dividend payers on the local market, with a gross yield of 3.2%.

The average gross dividend yield paid by the 20 companies is 6.3%, which is more than double compared to the highest yields on state bonds issued by the Romanian government. The investors that bought state bonds in the past two months got yields between 1.2% and 3.09% per year, depending on the securities’ maturities.

By Andrei Chirileasa, andrei@romania-insider.com