Raiffeisen Bank takes first place in the Romanian stock brokers’ ranking

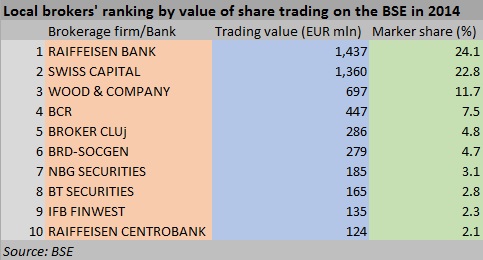

Raiffeisen Bank, one of the top five banks in Romania, brokered the largest transactions on the Romanian stock market in 2014, surpassing independent brokerage firm Swiss Capital for the first place in the local stock brokers’ ranking. Czech brokerage firm Wood&Company made it to top three for the first time since entering the Romanian market, in 2008.

Raiffeisen brokered share transactions worth EUR 1.44 billion, 70% larger than in 2013, and reached a market share of 24%, while Swiss Capital came second with EUR 1.36 billion worth of transactions and 23% market share, according to official statistics from the Bucharest Stock Exchange. Swiss Capital had been first in the brokers’ ranking for four years in a row.

Raiffesen Bank got the edge in 2014 due to electricity distributor Electrica’s initial public offering (IPO), which raised EUR 444 million from the Bucharest Stock Exchange and the London Stock Exchange. Raiffeisen also managed Fondul Proprietatea’s buyback program which included a EUR 188 million buyback public offering ended in December 2014. Raiffeisen was also involved in Fondul Proprietatea’s sale of a 13.5% stake in electricity transporter Transelectrica, a EUR 48.5 million deal.

Raiffeisen Bank’s brokerage business is led by Dana Mirela Ionescu, an executive with more than nine years of experience on the local capital market. Ionescu previously worked for Goldman Sachs and for Oaktree Capital Management in New York.

Unlike Raiffeisen Bank, Swiss Capital had no major deals (IPOs, private placements) in 2014. However, the local brokerage firm is the main broker for international investment funds trading on the Bucharest Stock Exchange and was on the buy side for many of these deals. Swiss Capital is led by Bogdan Juravle, one of the most experienced local brokers, who previously worked for ING Bank.

Czech brokerage firm Wood&Company also works with international clients, as well as for Fondul Proprietatea. Wood worked with local bank BRD on Fondul Proprietatea’s EUR 22.5 million sale of a 24% stake in oil pipe operator Conpet Ploiesti. Wood brokered transactions worth a total of EUR 700 million last year and had a market share of 11.7%.

Local BCR, Romania’s largest bank, came fourth in the brokers’ ranking, with EUR 447 million worth of deals and a 7.5% market share.

The total value of share trading on the Bucharest Stock Exchange, on the three segments (main market, RASDAQ and ATS) was just under EUR 3 billion (single counting), in 2014, about 14.5% higher than in 2013. Fondul Proprietatea, Banca Transilvania and Romgaz were the top trading shares.

Andrei Chirileasa, andrei@romania-insider.com