Chart of the week: Romania's retail sales growth slows down

Romania's retail sales expressed in comparable prices increased by 5.5% in 2018 compared to 2017, driven by households' earnings and banks pursuing abundant consumer lending. The expansion of the modern retail chains also supported consumption: the number of modern outlets rose by 16% year-on-year to 2,600 in 2018, compared to only 450 in 2008 when recession hit the country.

The annual growth was, however, half compared to that recorded in 2017 (10.8%), data from the National Statistics Institute (INS) shows. The rising interest rates and concerns related to the general economic conditions have depressed the consumer confidence, particularly toward the end of the year, taming the retail sales' growth both compared to the previous years and compared to the fundamentals. The outlook remains fragile and vulnerable to moderate exchange rate and fiscal stimulus corrections.

Retail sales rise, half the advance of households' earnings in 2018

The growth in retail sales in 2018 was mainly driven by higher wages (+8% in real terms, for January-November) and higher employment (+1.8% again for January-November) as well as more abundant consumer lending. In fact, both the aggregate net wages and the volume of consumer loans have increased by double-digit real rates making the 5.5% rise of sales look rather modest.

Local banks extended RON 36 billion (+12.6% year-on-year) new loans to households, out of which RON 22 billion (+18.9% year-on-year) were consumer loans. The volume of new consumer loans is the equivalent of the aggregated net wages earned in 1.7 months.

The above-average rise of wages among high-earning employees (less inclined to increase consumption but rather save) might explain this differential in principle, but such a scenario is highly unlikely since the driving force behind the better earnings remains the minimum statutory wage, earned by over one-third of the employees in the country. The slowdown is rather explained by deteriorating consumer confidence.

Retail sales gained momentum in Q4, but the outlook remains fragile

Both drivers, the real wages and the consumer lending, gained momentum in the last quarter of 2018 (Q4), which resulted in the retail sales accelerating to a 5.9% year-on-year advance in the quarter, from 3.9% year-on-year in Q3. The volume of new consumer loans soared by more than 35% year-on-year to RON 5.45 billion in Q4, dwarfing the headline inflation rate of around 3%. The net wages increased by more than 9% year-on-year in real terms in October and November, accelerating from an average advance of 7.8% year-on-year in Q3.

The outlook remains volatile, subject to both internal and external relevant risks. A further rise of the interest rates and currency weakening would carve into households' disposable income and furthermore into consumer confidence. Tighter lending regulations came into force, supplementary taxes prompted anxiety among banks and the national currency already shows signs of weakening. On the upside, however, the minimum statutory wage rose again in January, the labor market remains tight thus supportive to further rise of wages in the private sector (paralleled by investments in technology) and the retail chains remain optimistic with another 350 outlets scheduled for opening this year.

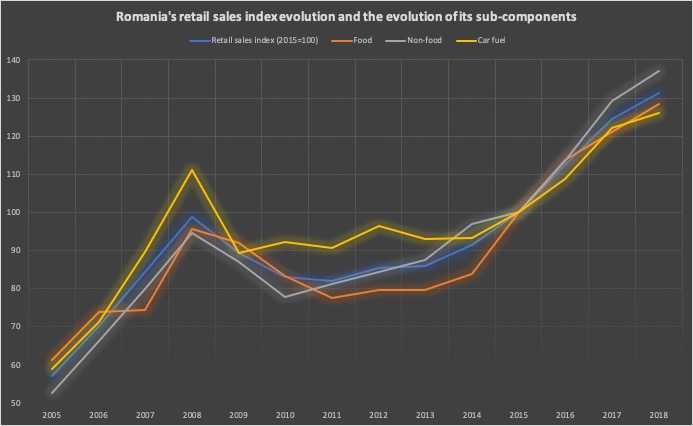

Romania's retail sales 60% above weakest post-recession level

The growth in retail sales visibly eased in 2018 from the double-digit rates in 2016-2017 but remained at a robust level in absolute terms. As a result, the retail sales volume was one third above pre-crisis peak level hit in 2008 and as much as 60% above the lowest post-crisis level in 2011. Even food sales, which are typically less elastic to household incomes, soared by 66% in 2018 compared to 2011 in line with the substantial 61% rise in the real wages combined with the 18% rise in employment over the same period of time. The sales of non-food goods soared by 69% since 2011 while the sales of car fuels posted a below-average growth rate of 39%.

Over the past 10 years, the average annual growth was 2.9% per annum. The sales of non-food goods increased by 3.8% p.a., faster than the sales of food (+3.0% p.a.) while the sales of car fuels advanced by only 1.3% p.a. (or 13.4% overall), which was surprising given the massive rise in the number of cars held by households.

by Iulian Ernst, Editor Romania-Insider.com; iulian@romania-insider.com