S&P lowers Romania's Transgaz ratings ahead of expected share package sale

Standard Poor's Ratings lowered its long-term foreign and local currency corporate credit ratings on Romanian natural gas transmission system operator Transgaz to 'BB' from 'BB+', with a negative outlook, due to regulatory uncertainty and high ongoing dividend payment, according to the ratings agency. The high dividend payments could weaken the group's financial risk profile in the near to medium term, according to S&P. Transgaz is due to be partially privatized mid-September, as the Government plans to sell a minority 15 percent stake in the company.

Standard Poor's Ratings lowered its long-term foreign and local currency corporate credit ratings on Romanian natural gas transmission system operator Transgaz to 'BB' from 'BB+', with a negative outlook, due to regulatory uncertainty and high ongoing dividend payment, according to the ratings agency. The high dividend payments could weaken the group's financial risk profile in the near to medium term, according to S&P. Transgaz is due to be partially privatized mid-September, as the Government plans to sell a minority 15 percent stake in the company.

Meanwhile, the regulatory environment for gas transmission activities in Romania has become less supportive, weighting on Transgaz's competitive position. This came after Romania's energy market regulator ANRE, failed to complete the revision of the existing tariff-setting mechanism by July 2012, which marks the beginning of the third five-year regulatory period. Inn S&P's previous scenario, this would have helped recover lost revenues, owing to lower-than-expected gas volumes shipped in recent years. So Transgaz is applying tariffs that are unchanged since 2009, and “ we believe that the prospects and timing of a tariff recovery remain highly uncertain,” according to S&P.

The ratings agency however expects Transgaz' adjusted debt, which was of some EUR 32 million end 2011, to fall in 2012 and 2013, while in 2014, the company should go back to normal investment levels. This, together with the ongoing high dividend payments, “is likely to lead to a gradual deterioration in financial credit metrics over the long term” according to S&P.

Transgaz Medias estimates its net profit will fall 6.4 percent to RON 355 million (EUR78.3 million) in 2012, from RON 379.5 million in the previous year.

Romania’s Government set a new date for the sale of a minority stake in national natural gas supply operator Transgaz. Originally scheduled for June this year, on August 8 the Government announced that the new deadline is mid September. The government will attempt to sell a 15 percent stake in the company as part of the series of sales of state owned energy companies Romania agreed with the EU and the International Monetary Fund.

editor@romania-insider.com

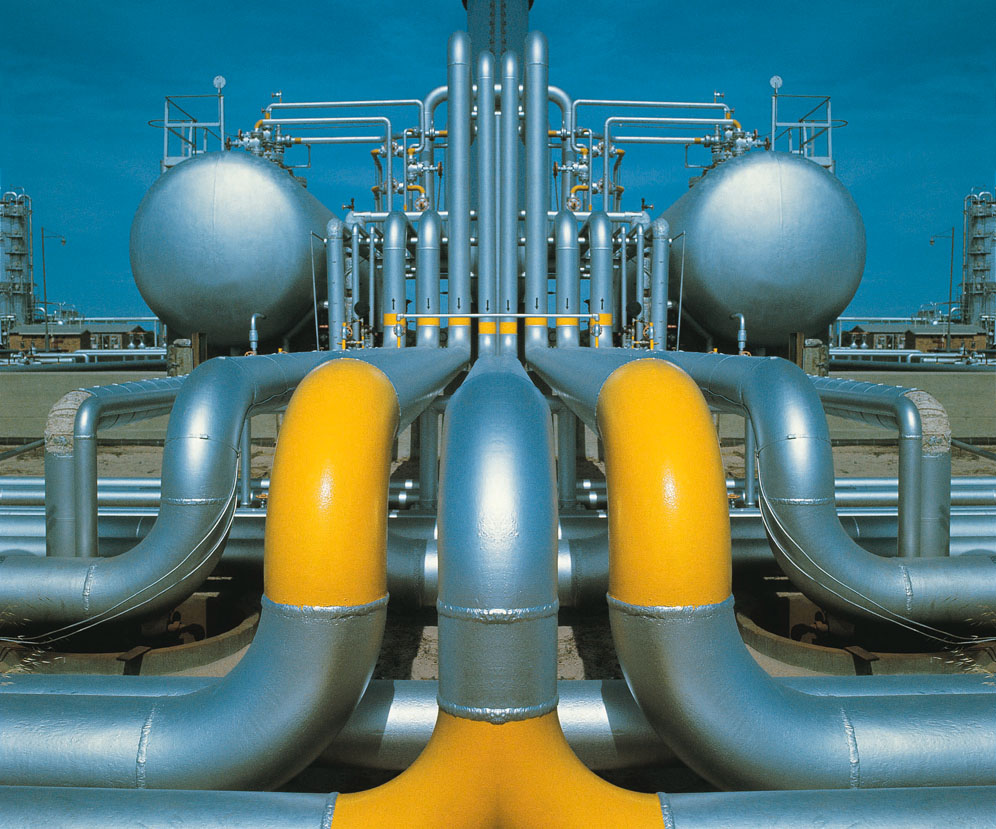

(photo source: sxc.hu)