BCR Romania Manufacturing PMI: Strongest improvement in manufacturing performance in survey history in May

-

Output and new order growth rates quicken

-

Supplier performance worsens further

-

Inflationary pressures strengthen

The Romanian manufacturing sector's performance improved further and to a greatest extent on record (since July 2023) in May, according to the latest BCR PMI® data. Output and new orders signalled faster upturns as demand conditions strengthened. In turn, companies stepped up their input buying and engaged in another month of job creation, albeit one that was only fractional amid staff shortages. Supplier delays remained, however, with lead times lengthening sharply.

Meanwhile, input costs rose at a faster pace, as inflation regained momentum. Firms raised their selling prices in response, and at a quicker rate.

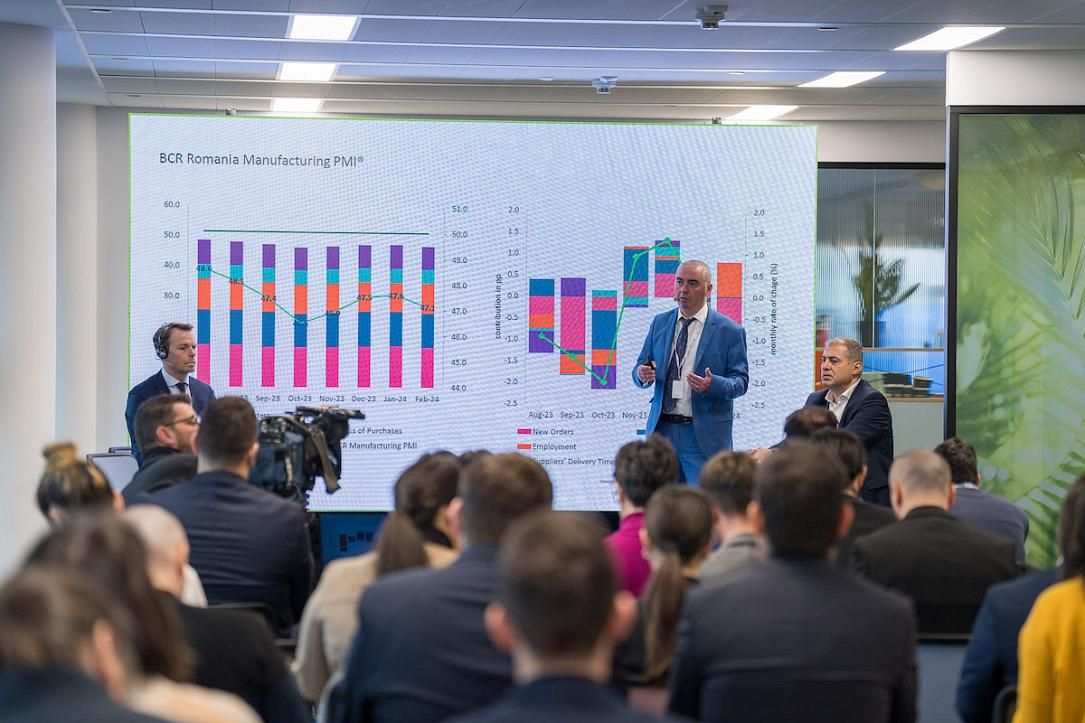

The headline BCR Romania Manufacturing PMI® is a composite single-figure indicator of manufacturing performance derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

A PMI reading above the 50.0 no-change mark signals an improvement in the health of the sector over the month, while a figure below 50.0 points to a deterioration.

At 52.0 in May, the headline figure ticked up from 51.5 in April and was the highest since data collection began in July 2023. Romanian manufacturers indicated a modest upturn in the health of the sector.

Output levels at Romanian manufacturers increased for the second time in as many months in May, as greater new order intakes led to a boost in production. The rate of growth quickened to a solid pace that was the fastest in almost a year of data collection.

Stronger demand conditions supported a sharper rise in new sales at Romanian goods producers in May. The solid increase in new orders was the quickest on record, as customer referrals led to new client wins.

External demand conditions fared less well, as a subdued sales environment in key export markets led to a further drop in new export orders. The rate of decline eased to the weakest in the 11-month series history, however.

At the same time, greater demand for inputs following the first increase in purchasing activity on record, the re-routing of shipments from Asia due to disruption in the Red Sea and supplier capacity issues led to a steep lengthening of suppliers' delivery times in May. The extent to which delays worsened was the greatest since data collection for the series began.

Subsequently, Romanian manufacturers saw only a fractional fall in inventory levels, as firms sought to build safety stocks of inputs.

May data pointed to a faster rise in input costs at Romanian manufacturing firms. The pace of inflation accelerated from that seen in April and was quicker than the series average. Greater cost burdens were linked to higher supplier, transportation and fuel prices.

Romanian goods producers continued to raise their selling prices in May, thereby extending the current sequence of charge inflation to seven months. Although only marginal, the rate of increase picked up to the fastest in three months, as firms sought to pass-through costs and make adjustments due to improvements in product quality.

Workforce numbers at Romanian manufacturers rose for a second month running midway through the second quarter. That said, challenges finding suitable staff to replace voluntary leavers hampered job creation which was only fractional overall.

Delays to input deliveries and some reports of staff shortages led to only a slight decrease in backlogs of work during May. Moreover, the pace of depletion was the weakest since last September.

Finally, output expectations among Romanian manufacturing firms improved in May. The degree of confidence ticked up to the strongest on record (since July 2023) amid hopes of new client wins and planned investment in new technology.

Ciprian Dascalu, Chief Economist at BCR said:

"The BCR Romania Manufacturing PMI remained above 50 in May and posted yet another record reading at 52.0, from 51.5 in the previous month. May figure represents the highest reading since the beginning of data collection in July 2023. Managers in the Romanian manufacturing sector reported an improvement in business activity in May for the second consecutive month, showing clear signs of recovery in the Romanian manufacturing sector. New orders and output remained above 50 and were the main drivers for this month’s reading. Employment remained in expansionary territory but had a negative directional contribution this month, as the reading came in below previous month. The only other negative directional contribution in May came from stocks of purchases, though holding a small weight, the effect on the headline PMI is only marginal. The HCOB Flash Manufacturing PMI Output Index for the German economy, the main trading partner for the Romanian manufacturing sector, showed some improvement in May reaching a 13-month high, but remained below the 50 neutral level.

"Output index came in above 50 for the second month in a row, with the growth rate higher than the previous month. This is linked to stronger demand conditions and higher new orders, according to the responses from the panellists. New orders were also on the rise in May, with client referrals, new customers wins, and improved sales environment reported as the reasons behind it. On the other hand, export orders remained in contractionary territory, albeit at a slower pace, showing that external demand remains weak, especially in Europe and remains a drag for the Romanian manufacturing sector. Historically speaking, a significant portion of the manufacturing output in Romania is destined for export markets, therefore the external demand evolution will most likely be detrimental for any meaningful acceleration of the manufacturing growth rate in the months ahead. Regarding business expectations the survey contributors remained optimistic regarding future business prospects in May, with strengthening demand conditions, new customers acquisitions and investments in new technologies cited as factors of optimism. This can only be interpreted as a positive sign for the months ahead.

"The employment component of the PMI index remained above 50 for the second consecutive month, however, the pace of improvement was only marginal, and some challenges were reported in replacing voluntary leavers. This phenomenon is not new for the Romanian labour market, and it transcends the manufacturing sector. The number of job vacancies remains above the number of persons actively seeking jobs in Romania indicating a tight labour market. Furthermore, there is also a problem regarding finding workers with the right skills for the job. Even if some problems in replacing voluntary leavers were reported, backlogs of work declined in May, indicating that the current capacity is sufficient to process incoming work, though some companies noted staff shortages and supplier delivery delays as problems for completing current orders.

"Quantity of purchases was up in May, showing an uptick in input buying, which is linked with the rise in new orders. Suppliers’ delivery times worsened in May to the strongest degree recorded so far with supplier capacity shortages, re-routing of shipments from Asia due to the Red Sea disruptions cited as main reasons behind this development. The geopolitically linked disruptions most likely will continue to have a negative effect on inputs supply in the coming months.

"Input prices were up in May, as higher transportation, fuels and supplier prices reportedly drove an uptick in operating expenses. Output prices rose by a lesser extend indicating that the burden of higher input prices was not fully transmitted towards the consumer. Output prices in the manufacturing sector are closely linked to the consumer prices, though the effects are usually seen with some lags. Some inflationary pressure might come from manufacturing sector producer prices toward the consumer prices based on the PMI data so far.

"Based on PMI data for the first quarter, we can assume that the manufacturing sector will not be a contributing factor for the economic growth in the first three months of the year, as the average index stands below 50. Second quarter, however, might show a positive contribution, as PMI data for the first two months of the quarter suggests. Manufacturing accounts for around 15% to 20% of the gross value added in Romania."

*This report is provided by BCR Research.