Romania’s manufacturing industry stagnates below pre-crisis peak

Romania’s industrial production has slightly weakened in the first five months of this year, by 0.8% compared to the same period of 2021 - but it looked much weaker (-4.2%) compared to the first five months of 2019, before the pandemic.

Speaking of the manufacturing industries alone, their average annual performance is slightly in the positive area (+0.3% YoY) but compared to 2019, it still lags by nearly 4%.

The performances of individual industries are diverse: a small number of sectors, such as the production of food, beverages, and construction materials, are performing constantly well while others (among which car production, chemical industry and energy-intensive industries in general) are losing ground.

The sectors of mining and quarrying (-4.4% YoY) and utilities (-6/1% YoY) are underperforming in both annual terms and compared to the pre-crisis period.

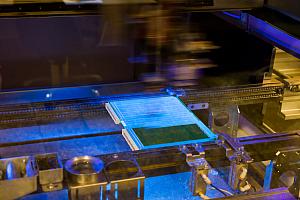

Looking deeper into the activity of the manufacturing industries, car production has contracted by 9.8% YoY in the first five months of 2022 and by 16.4% compared to 2019.

Chemistry (dragged down by the production of fertilizers) collapsed by 21.1% YoY, and it lags by 11% versus 2019.

The production of construction materials, helped by robust construction activity, shows resilience: it increased by 6.2% YoY and by 11.6% versus 2019, in the first five months of the year.

The production of food and beverages is also among the best-performing sectors: +6.9% YoY and +3.9% YoY respectively, and even better performances compared to 2019.

Despite positive annual rates, the light industries lag to various, but consistent, degrees versus 2019.

(Photo: Pixabay)

iulian@romania-insider.com