BCR Romania Manufacturing PMI: Romanian manufacturing downturn softens in March

-

New orders and output fall at the slowest rates on record

-

Declines in purchasing and input stocks ease

-

Firms choose to largely bear cost inflation burden to encourage sales

Romania's manufacturing economy remained just inside contraction territory at the end of the first quarter, although the health of the sector deteriorated to the least extent in the nine-month survey history so far. Both output and new orders continued to decline in March, but at the slowest rates on record. Meanwhile, firms continued to utilise current input inventories while cost inflation remained elevated. Despite sharply rising input costs, selling prices were increased only slightly in March, with some firms discounting charges to encourage new sales.

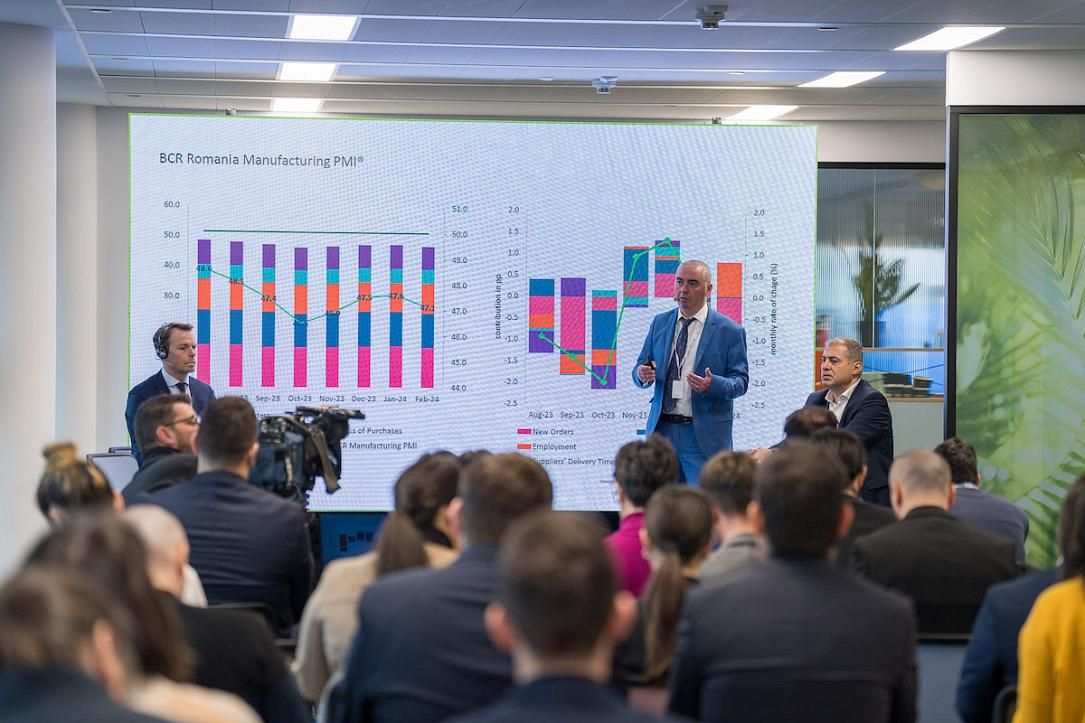

The headline BCR Romania Manufacturing PMI® is a composite single-figure indicator of manufacturing performance derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

A PMI reading above the 50.0 no-change mark signals an improvement in the health of the sector over the month, while a figure below 50.0 points to a deterioration.

Posting at 49.3 in March, up from 47.1 in February, the headline PMI indicated the softest deterioration in operating conditions for Romanian manufacturers since the survey began in July 2023.

Central to the improved headline reading was a lower contraction of new orders, in addition to softer declines in both output and preproduction inventories. The only negative directional influence on the PMI was slightly sharper job shedding.

According to panel members, an unfavourable economic climate and tight customer budgets led to muted demand for Romanian manufactured goods. Though new orders have fallen in each month since data collection began in July, March recorded the softest decline in the survey's history.

Concurrently, a further drop in new export orders weighed on total sales in March, reflecting subdued demand from abroad. Although the weakest since data collection began in July, the rate of contraction was nevertheless solid.

Subsequently, manufacturers across Romania recorded another drop in production volumes in March, thereby stretching the trend of reductions to nine months. That said, the speed of decline was only modest and also the slowest on record.

The drop in new work pushed firms towards working through their backlogs. The level of outstanding business has fallen in each month of the past three quarters, with some firms blaming subdued order numbers and others attributing backlog completion to increased productivity. The rate of depletion was solid and the fastest recorded this year so far. At the same time, Romanian manufacturers continued to cut jobs in March, though only slightly.

In addition to reduced workforce numbers, elsewhere firms carried out cost cutting activities, continuing to run down input stocks and reduce purchasing activity in line with falling sales. The respective rates of decline eased on the month and were moderate overall.

Meanwhile, amid ongoing disruption to supply chains across the Red Sea, Romanian goods producers continued to report longer average lead times. The deterioration in vendor performance was solid and the most pronounced since July (when data collection began).

Suppliers continued to raise prices at a rapid pace in March. As well as increased raw materials, firms mentioned raised tax burdens and fuel costs. With around 21% of manufacturers reporting an increase in input prices, compared to only 2% registering a drop, the rate of cost inflation was sharp. Customers only felt some of the burden of higher costs in March as manufacturers across Romania indicated a marginal increase their output charges. Some companies raised prices due to higher cost pressures, while others discounted selling prices in an attempt to stimulate demand.

Looking ahead to the coming year, future output expectations remained upbeat in March. The degree of positive sentiment ticked higher, driven by planned machinery investment, optimistic growth projections and product diversification.

Ciprian Dascalu, Chief Economist at BCR said:

“The BCR Romania Manufacturing PMI bounced back in March, reaching its strongest reading since the start of the data collection in July 2023, though it remained below the 50.0 threshold which indicates contraction vs the previous month. New orders were the main driver of the rebound, followed by output, both posting the highest readings on record. Nevertheless, both new orders and output declined in March, but at the lowest pace on record. Export orders continue to drag the Romanian manufacturing sector with export orders significantly below the 50.0 no-change mark, though posting the lowest monthly contraction. This is in line with the weak flash HCOB Germany Manufacturing PMI March release. The other components had a positive directional contribution except for employment.”

“The BCR Romania Manufacturing PMI has remained in contractionary territory since the start of the data collection in July 2023. With exports accounting for about 43% of the manufacturing production in Romania, a meaningful recovery is unlikely unless we see a sustained improvement in external demand. Nevertheless, the managers in the sector are rather optimistic about production over the next 12 months with the Future Output Index improving in March and remaining above the historical average. Growth outlook, investments and product diversification are cited as sources for better prospects. It is yet to be seen if these would lead to improved competitiveness, which can offset the recent fast wage hikes, or further investments in automation and job shedding would be the solutions to compensate for higher labour costs. The Manufacturing PMI remained in contractionary territory in the first quarter of the year but improved vs the previous quarter, on average.”

“Despite reports of higher taxes and fuel costs, input price inflation slowed marginally in March from the all-time high in February. The increase in input prices was mostly accommodated by shrinking profit margins as the output price inflation decelerated to a larger extent.”

*This report is provided by BCR Research.