Doing Business in Romania? Tax tips for foreign entrepreneurs and executives (A)

The standard corporate income tax rate is 16%, applicable to both Romanian companies and to foreign companies operating through a permanent establishment in Romania.

Profit repatriation

In case of the Romanian company being set up as a subsidiary of a foreign company profits may be repatriated solely by way of dividend distribution, which, according to domestic law, is allowed only after the annual financial statements are approved by the shareholders. Advance payments on distribution of dividends before the end of the financial year are not allowed.

Domestic provisions

As a general rule, non-resident companies not operating through a permanent establishment are subject to 16% withholding tax in Romania on income from sources in Romania (e.g. dividends, interest, capital gains, management and consulting fees, services rendered in Romania and outside Romania, with some exceptions).

Tax Treaty provisions

The domestic withholding tax rate can be reduced through the application of Double Taxation Treaty (DTT) concluded between Romania and other countries. Application of the DTT provisions requires the non-resident entity to present a certificate of fiscal residency from its home country to vouch for Treaty eligibility.

So long as a tax treaty is in place and provided a fiscal residency certificate of the foreign supplier is made available, the purchase of “simple services” from a non-resident are as a general rule not subject to any withholding tax in Romania. (for example article 7 of the DTT between Romania and the UK).

Note that a point of concern may arise with respect to services which could be deemed to involve a hidden transfer of know-how (this particular point of concern usually arises in the case of management, consultancy and technical assistance services). If such a transfer of know-how is deemed to arise, than the corresponding fees would be regarded as royalties, subject to withholding tax.

As a general rule, withholding tax must be withheld by the Romanian payer of the income and must be paid to the Romanian State Budget by the 25th of the month following the month when the income is paid.

Tax credit

The DTT conventions concluded between Romania and other states may provide that non-residents deriving revenues from Romania may obtain credit for the tax paid in Romania in relation to such revenues.

In accordance with the Romanian Tax Code, in order to obtain tax credit for the revenue derived from Romania, non-residents must file with the Romanian competent tax authorities an application requesting the issuance of a “Certificate attesting the tax paid to the Romanian state budget” by either the non-resident or by a person acting on their behalf. The competent tax authority will issue a “Certificate of tax paid by non-resident legal persons” which may subsequently be used by the non-resident in order to obtain tax credit in their countries, according to the provision of the laws of the respective countries.

Dividends

For dividends paid by a Romanian company to a company resident in another EU Member State, an exemption on withholding tax (0%) is granted provided that the non-resident company holds at least 10% of the share capital of the Romanian company for a continuous period of at least one year prior to the date of payment of dividends and the Romanian company is a corporate income tax payer.

If at the interest / royalties / dividends payment date, the two years / one year minimum holding period has not ended, the exemptions will not apply. When it can be proved that the minimum holding period has been completed after the payment date, the Romanian company can apply for reimbursement of the taxes paid in excess.

Given the above, we recommend that the Romanian companies consider the possibility of paying / distributing the interest / royalties / dividends (if the case) only after the two year / one year period is fulfilled provided that the company also holds at least 25%, respectively 10% of the share capital during this period.

Disposal of local company / Capital gain tax

Capital gains derived by non-resident entities from the disposal of shares held in a Romanian company (such as a S.R.L. – the Romanian equivalent of an LLC) are normally subject to 16% Romanian corporate tax. In line with the provisions of the art 30 of the Romanian Tax Code, if the Romanian company is a “real estate” company (i.e. a company with more than 50% of its long terms assets consisting of real estate located in Romania, either held directly or indirectly via other legal entities and/or individuals), any sale proceeds resulting from capital gains are considered to be real estate income.

The Tax Code also states that if Romania concluded a Double Avoidance Tax Treaty with the country of residence of the foreign company deriving income taxable in Romania, the provisions of the Double Avoidance Tax Treaty will prevail over the Romanian legislation.

As a general rule, in order to enjoy the tax treaty protection (and not be liable to pay capital gains tax in Romania), non-resident companies earning income from Romania would need to prove their tax residence to the Romanian tax authorities by way of a tax residence certificate. Otherwise, in the absence of a tax residence certificate of the non- resident entity at the moment of collecting the income from Romania, the 16% Romanian domestic withholding tax would apply and only upon later presentation of the tax residence certificate (within a period of maximum 5 years following the payment of the income) can the tax overpaid be reclaimed.

Even if no corporate gains tax would be due in Romania based on the provisions of a Double Avoidance Tax Treaty, the non-resident company realizing capital gains from sale of shares held in a Romanian company nevertheless has to appoint a fiscal representative in Romania in order to submit the annual corporate tax return (even if mentioning a zero liability) and the fiscal residency certificate for the income beneficiary.

Certain tax benefits are provided by the Romanian tax legislation with respect to reorganization operations involving Romanian entities (such as mergers, spin-offs, transfers of assets and liabilities in exchange for participation titles, purchase of participation titles). Provided that certain conditions are met, the Romanian tax legislation provides that such operations should be tax-neutral, i.e. they should not give rise to taxation, nor should they give rise to tax advantages.

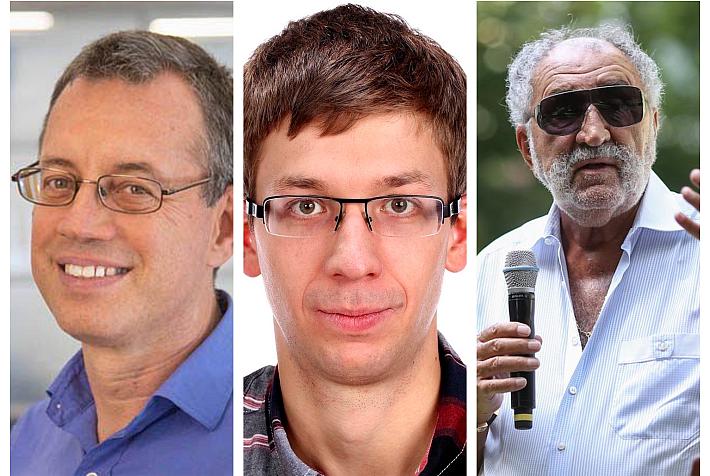

About the author

Christian Bogaru is the Managing Partner of BWSP Hammond Bogaru & Associates and is an experienced lawyer advising Romanian and international clients on a wide variety of transactions and general corporate work. This includes private and public M&A, start-up advice, capital markets, private equity and venture capital investments, re-organizations and international commercial agreements.

Contact Christian Bogaru at cbogaru@hbalaw.eu / +40 21 326 60 53

BWSP Hammond Bogaru & Associates is an international law firm advising and representing clients on a wide scope of legal issues through our dedicated practice areas. We are the Romanian partner of BWSP Legal, a strategic partnership formed to give integrated legal advice and representation to clients doing business in Central and Eastern Europe.

Visit www.hbalaw.eu for more information on our legal services.

(a) - this article is an advertorial