Romania’s BVB, sole European stock exchange with one of the biggest IPOs of 2023

Romanian company Hidroelectrica, a leader in the production of 100% renewable energy, was listed on the Bucharest Stock Exchange - BVB on July 12, following the largest IPO ever conducted in Romania: USD 2 billion. The Hidroelectrica IPO is the sole one from the European Union to make it in the top 5 biggest of the year.

An initial public offering, or IPO, is the process of offering shares of a private corporation to the public in a new stock issuance for the first time.

IPOs have been fewer in both number and value globally so far this year, and shareholders' appetite to bring new companies to the stock exchanges, especially in the US and Europe, has been overshadowed by activity in Asian markets, according to an analysis by the Bucharest Stock Exchange cited by Economedia.

"The largest initial public offering so far this year was USD 5.2 billion and was conducted by Arm, a company registered in the United Kingdom and listed on NASDAQ, USA. Kenvue, an American company, was listed on the New York Stock Exchange, NYSE, after a successful USD 4.4 billion offering. Ranking third in the top of the largest globally successful IPOs so far this year is Adnoc Gas from the United Arab Emirates, a company listed on the Abu Dhabi Stock Exchange after a USD 2.5 billion IPO. [...] In fifth place is Nexchip, a Chinese company listed on the Shanghai Stock Exchange after a USD 1.9 billion offering. BVB was the only stock exchange in Europe with a significant IPO globally [coming in at the fourth place]. Hidroelectrica's USD 2 billion offering placed BVB fourth in the global ranking in terms of the value of an offering recorded in the first three quarters," the BVB report states.

The Romanian capital market has gained visibility both internationally and domestically as a result of the listing. At the end of the first nine months of the year, the number of investors in the Romanian capital market reached a new historical high: 168,000 investors, tripling compared to five years ago.

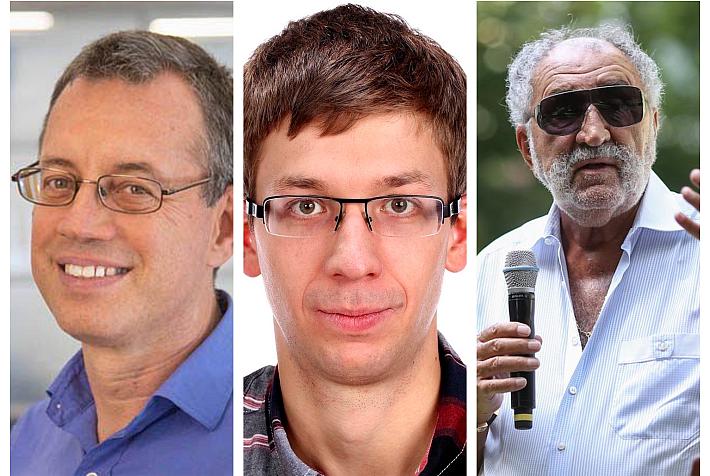

"The Romanian capital market has become increasingly visible among international investors. We have noticed an increase in the representation of Romanian companies in the FTSE Russell and MSCI indices. In terms of visibility, companies listed on the BVB and the BVB indices appear in the financial data of the most well-known financial platforms, and we are in discussions to expand this horizon so that international investors have easy access to data on Romanian companies. At the level of Romanian investors, the latest data reaffirm the upward trend: we have 16 consecutive quarters of growth and a new historical high of 168,000 investors, a 211% increase in the last five years, meaning a tripling of those accessing the capital market. Just this year, we have 35,000 new investors due to the Hidroelectrica offering and the continuation of the Fidelis bond program," said Radu Hanga, president of the Bucharest Stock Exchange.

According to the report, the total trading value of all types of financial instruments on the Regulated Market of the BVB reached an absolute record at the end of the first 10 months of this year, exceeding RON 29.4 billion, equivalent to EUR 5.9 billion. The average daily liquidity this year reached RON 141 million, equivalent to EUR 28.5 million.

(Photo source: BVB photo)