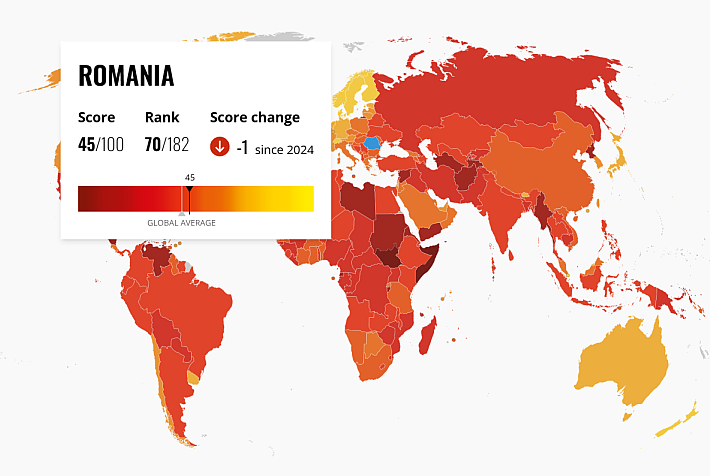

Country Risk Atlas 2024: Romania’s public finances became a cause for concern

Romania’s public finances will continue to deteriorate and have become a cause for concern, according to the Romanian edition of the Country Risk Atlas 2024 published by Allianz Trade Research.

Despite some planned fiscal consolidation, Allianz Trade Research projects the annual deficits to remain high at about -5% of GDP in 2024-2025. Meanwhile, the public debt-to-GDP ratio is forecast to reach about 50% in 2025 after it increased from 35% of GDP in 2019 to 47% in 2022.

While this still appears modest compared to other EU countries, the trend dynamics are a reason to worry.

Romania’s external finances are another cause for concern. The current account deficit widened steadily from -0.3% of GDP in 2014 to -9.3% in 2022, before narrowing slightly to an estimated -6.5% in 2023.

As regards the real economy, Allianz Trade concludes that Romania’s economic prospects have significantly deteriorated since the war in Ukraine due to the country’s (pre-war) energy import dependence on Russia and the impact of EU sanctions against Russia on the domestic economy (for example rising inflation and potential energy shortages).

The impact of surging inflation, rising interest rates, weakening external demand, and deteriorating business confidence took full effect in 2023 (when the GDP advanced by only 2%) and will strengthen only gradually.

Growth is forecast to pick up to around +3% in 2024 and +3.5% in 2025, supported by resilient public spending and investment as well as strengthening consumer spending on the back of rising real disposable income, a fading impact of past interest rate hikes and some monetary easing.

iulian@romania-insider.com

(Photo source: Antonyesse/Dreamstime.com)