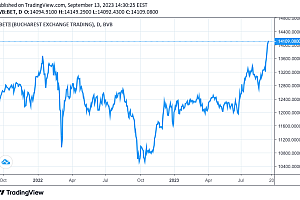

Bucharest Stock Exchange breaks liquidity record in first eight months of 2023

Liquidity measured as the total trading value with all types of financial instruments listed on the Regulated Market of the Bucharest Stock Exchange (BVB) reached a new record level of RON 24.5 billion (EUR 5 billion) in the first 8 months of this year.

Four months before the end of this year, the BVB has already broken the previous full-year liquidity record set in 2022, when the total transactions rose to RON 23.2 bln.

The Hidroelectrica IPO had a significant contribution to the overall increase in liquidity on the Bucharest Stock Exchange. The transactions with Hidroelectrica (H20) shares processed by the BVB reached RON 11.3 bln in July and August, including the IPO transactions worth RON 9.3 bln.

The increase in transactions was also accompanied by an increase in share prices. In the first eight months of the year, the BET-TR index gained 17.8%.

Radu Hanga, BVB President, commented: “The capital market in Romania is going through one of the best periods in history and what we witness now is the result of a combination of factors and the efforts made by BVB and the capital market community in the last 5 years. We believe that these results need to be reinforced, not just celebrated, and that is why it is more important than ever to have predictability and encourage investments in the capital market.”

He added: “We welcome the statements of the Romanian Government whereby several companies in which the state is the majority shareholder will list minority stakes on the Bucharest Stock Exchange, which will make the Romanian state retain control in these companies and benefit from good coverage and additional revenues using the mechanisms offered by the capital market. The Hidroelectrica example can be replicated, obviously keeping the proportions, by other companies in the state portfolio relevant to the Romanian economy.”

Government may list more minority stakes in state companies on the BVB

“We have received clear signals from the Government that 3 other state-owned companies would list minority stakes on the BVB by 2026, as part of the commitments made through the PNRR, which represents a favorable message for Romanian investors. Thus, we have very good premises for the Romanian economy to be represented even better on the local stock exchange, both at a sectorial level and at the level of the population’s participation in the investment phenomenon,” said Adrian Tanase, BVB CEO.

“Also regarding the development of the capital market in the near future, our projects developed together with the broad participation of the capital market community continue, and I would like to mention here a very important project in this picture of the development of the market such as the establishment of the Central Counterparty in Romania, and the signals are encouraging. Some of the results of the efforts made so far are already visible and reflected in the evolution of the market, the number of listed companies, or the number of investors compared to what was happening 5 years ago,” he added.

The number of investors in the Romanian capital market continued to grow and reached almost 160,000 investors at the end of the first semester of 2023, according to data from the Investor Compensation Fund (FCI). By comparison, in 2019 there were almost 54,000 investors. This represents a 200% increase over the past five years.

editor@romania-insider.com

(Photo source: BVB)